Low-latency networks and high-performance data centers are bolstering Asian financial markets

NTT Com Global Watch vol.3, Revised March 2015

International financial trading systems continue to operate at ever-increasing speeds. In transactions that require peak performance from computers and networks, even microsecond (1/1,000,000 second) delays can have devastating results. As a consequence, demand is rising in fast-growing Asian financial markets for networks that enable faster, more reliable high-frequency trading. This demand has put the spotlight on NTT Communications' backbone network, which links Asian financial centers (Tokyo, Hong Kong and Singapore) with North American exchanges and high-performance data centers.

The microsecond precision of high-frequency trading is spreading to Asia

In the world of financial trading, a moment's delay in decision making can mean the difference between a million dollar profit or loss. The efficient generation of profits in today's financial markets requires swift access to trading data, quick discernment of trading opportunities and action without delay.

Due to algorithmic trading that automates trades via computer programs, trading data is being assessed at increasingly high speeds. Computer-based high-frequency trading, which initiates thousands to tens of thousands of orders per second, is having an especially dramatic impact on the market.

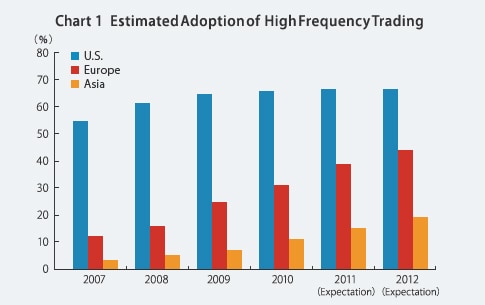

High-frequency trading accounts for a rising percentage of equity orders in major markets. It already comprises nearly 70% of equity orders volume in the U.S. and is rapidly expanding in European and Asian markets as well. High-frequency trading is projected to account for 20% of all equity orders in the Asian market in 2012.

Source: Aite Group: Connecting to Future Opportunities: Cross Border Low Latency Connectivity

In the U.S. financial services industry, it is said that brokers with electronic trading systems just 1 millisecond slower than competing systems may suffer losses up to millions of dollars per trade, leading to enormous accumulated losses over time. As a result, low-latency trading systems have become an area of competition among stock exchanges.

To enhance competitiveness, the Tokyo Stock Exchange brought its trading system up to foreign standards in terms of speed, safety and expandability by launching a next-generation trading system called "arrowhead" in January 2010. The system features an order response time of 2 milliseconds and there are plans to achieve 1-millisecond or higher speeds by May 2012*1.

Of course, improving the performance of a trading system itself is insufficient for a stock exchange to catch up with faster rivals. The speed of international telecommunications circuits, quality of information networks and functions offered by data centers also play crucial roles.

The network linking the Asian and North American stock exchanges is currently attracting considerable attention. London, New York and Tokyo were previously considered the three major international financial centers. But Tokyo has been supplanted by East Asia (Hong Kong, Singapore, Shanghai and Tokyo) due to stagnation of Japan's economy since the 1990s and concurrent growth in other Asian markets.

Hong Kong and Singapore, in particular, have been drawing attention as Asian hubs where the use of high-frequency trading is significantly expanding.

*1 Source: The Nikkan Kogyo Shimbun (Business & Technology Daily News): October 27, 2011 edition (Japanese only)

Back to top

Hong Kong and Singapore are taking the lead in Asian financial markets

Hong Kong financial markets continue expanding, supported by growth in mainland China

Hong Kong and Singapore are playing major roles in the international financial market.

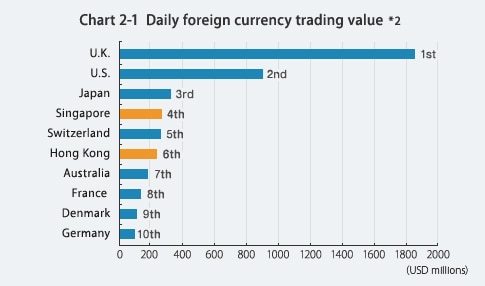

[See charts 2-1 and 2-2.]

Hong Kong is renowned as one of the world's major markets for currencies and stocks. It ranks third in Asia and sixth in the world as a foreign currency market and boasts an average net daily turnover of 237.6 billion U.S. dollars.*2 As of the end of 2010, the Hong Kong Exchange (HKEx) was the third largest stock market in Asia and seventh largest in the world in terms of market capitalization (2.7 trillion U.S. dollars).*3 One notable feature of the Hong Kong stock market is the large number of Chinese companies listed. In fact, Chinese companies account for 55.5% of the market's total capitalization.*4 As Hong Kong strengthens its economic and trade relations with mainland China, it is solidifying its position as a key financial center in the Asia-Pacific region.

Singapore successfully carried out dramatic financial reforms

Business-friendly financial and tax regulations, as well as countless professionals versed in finance and fluent in English, are among the many reasons Hong Kong has become an Asian financial hub. The same can be said for Singapore, where the average daily turnover in foreign exchange markets amounts to 266 billion U.S. dollars, or 5.3% of the worldwide total.*2 These figures are quite similar to those of Hong Kong (237.6 billion U.S. dollars or a 4.7% global market share).

Singapore successfully implemented financial reform prior to Japan and other Asian countries. As competition among major exchanges intensified worldwide, the Singapore Exchange (SGX), which was created through a 1999 merger, carried out various deregulations and drastic reforms. The SGX has enthusiastically strengthened ties with exchanges in the U.S., Europe, Australia and other Asian countries. In 2007, the SGX also launched the Catalist stock exchange to encourage stock listings by startups in China, India and other emerging countries throughout Asia.

Buoyed by economic growth in emerging countries throughout Asia, financial markets in Hong Kong and Singapore have become increasingly important. Since the volume of high-frequency trading is escalating in these markets (as in the U.S. and Europe), expectations are rising that Hong Kong and Singapore will develop highly reliable financial trading infrastructures that closely link with offices throughout Asia and seamlessly connect with the U.S.

*2 Source: Data as of April 2010 by Bank for International Settlements (BIS)

*3 Source: Data as of December 31, 2010 by World Federation of Exchange (WFE)

*4 Source: Hong Kong Trade Development Council (HKTDC): Economic and Trade Information on Hong Kong

Back to top

An "Asian Triangle" links major Asian data centers

Fully functional data centers in Hong Kong and Singapore

NTT Communications continues to bolster the financial trading infrastructure throughout Asia. In Hong Kong, construction began in the third quarter of fiscal year 2010 (Japan GAAP) on a premium data center that will meet or exceed international Tier III data center standards.*5 This Hong Kong TKO data center, which will also be eco-friendly, is slated to begin providing services in 2013 (Jan-Mar).

In Singapore, NTT Communications initiated construction of a new premium data center in July 2010. The Serangoon Data Center, like the Hong Kong TKO data center, will meet or exceed international Tier III data center standards. This new data center is attracting the interest of IT and financial firms in Singapore as strategic infrastructure for expanding their business.

An ultra low-latency network connects 3 Asian hubs with the world

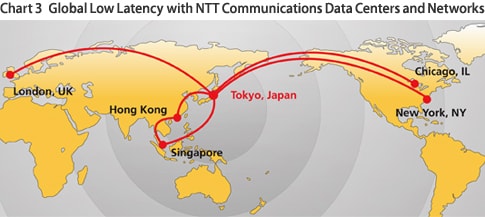

In addition to new high-performance data centers in Hong Kong and Singapore, NTT Communications has been building a low-latency network that connects East Asia with the world. By minimizing the latency between various financial centers, this network is strengthening financial businesses worldwide.

Our fully functional data centers in Tokyo, Singapore and Hong Kong serve as hubs connecting the financial centers in these "tripolar" markets via high-speed network. This "Asian Triangle" links seamlessly with major data centers in the U.S.

NTT Communications' data centers and worldwide networks support ultra low-latency trading in financial markets worldwide. The Asian triangle connecting Tokyo, Hong Kong and Singapore (center of chart) also links with North American and European markets.

This ultra low-latency network supports near instantaneous response rates for high-frequency trading. It already links New York, Chicago, Tokyo, Hong Kong, Singapore and London and utilizes our PC-1 undersea cable ? the world's fastest and most direct route between the U.S. and Japan. This same PC-1 undersea cable will be utilized in an end-to-end service linking the Chicago Mercantile Exchange (CME) with financial markets in Tokyo, thus providing the shortest distance and lowest latency available.

To support financial networks expanding to Asia from North America and Europe, and enhance its customer support around the world, NTT Communications will continue offering leading network and high-quality data center services in major markets.

*5 International data center standards established by the Telecommunications Industry Association (TIA) and The Uptime Institute Inc. (TUI) enable thorough, quantifiable evaluation of data center quality and reliability at different levels (tiers) through detailed examination of management systems, subsystem redundancy (including power supply and air-conditioning), etc. Defined data center levels range from Tier I to Tier IV (the most stringent level).

EN

EN